Summary:

- Bitcoin whales are depositing less BTC to crypto exchanges

- This is a possible sign of seller exhaustion by Bitcoin whales

- Institutional investors continue scooping up BTC

- Bitcoin could very well attempt a $30k all-time high

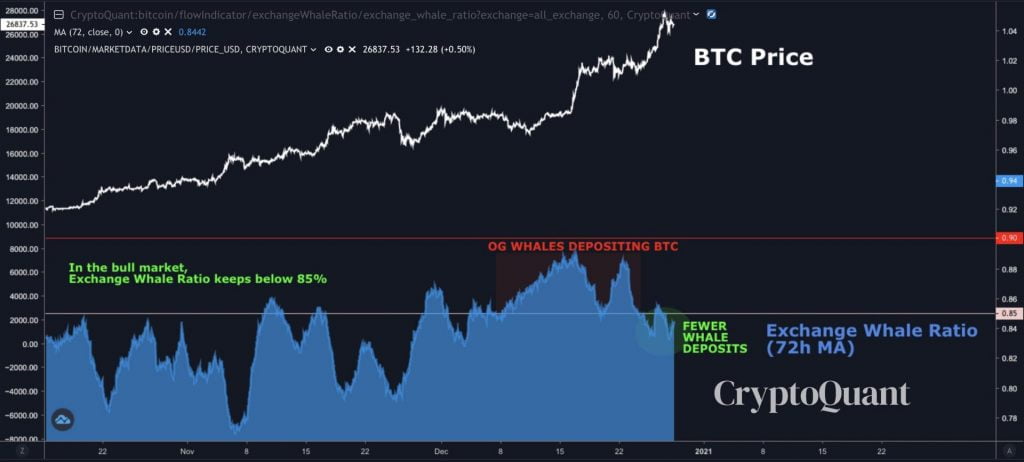

Bitcoin whales are making fewer deposits of their BTC to crypto exchanges. This is according to an analysis by the CEO of CryptoQuant, Ki Young Ju, who suggested that the decrease in deposits by Bitcoin whales could be a sign of seller exhaustion. Mr. Ju also pointed out that institutional investors are continually scooping up Bitcoin from crypto exchanges.

Mr. Ju’s exact statement can be found below alongside a chart from CryptoQuant demonstrating a reduction in BTC deposits by Bitcoin whales.

$BTC whales seem exhausted to sell. Fewer whales are depositing to exchanges. I think this bull-run will continue as institutional investors keep buying and Exchange Whale Ratio keeps below 85%.

Bitcoin sets a New All-time High of $28,445, $30k Within Sight

At the time of writing, Bitcoin is trading at the $27,300 price area in what looks like consolidation geared towards an attempt at breaking the recently set all-time high value of $28,445. The latter value was set yesterday, December 27th and could be a precursor for Bitcoin attempting the $30k price ceiling.

Such a scenario has been explored by the team at Crypterium analytics who have forecasted that $30k will most likely be breached based on the expectations of traders and analysts as explained below.

It is difficult to say where Bitcoin will head next, but the range of $28,000 — $28,500 can be noted. If the chart can gain a foothold at this level, then we will see a breakthrough to $30,000. And this is where the biggest resistance will be. Many analysts and traders predicted growth to exactly this mark, so that is where the next major fixations will be.

Bitcoin’s Monthly and Yearly Close Could Bring Volatility

Also worth mentioning is that the month of December and the year 2020 come to a close this Thursday, December 31st. This means that traders and investors will be observing Bitcoin’s monthly and yearly closing candles. Such an event has a high probability of eliciting volatility in the markets as Bitcoin bulls attempt to close both the year and month on a high note. At the same time, Bitcoin bears will most likely attempt to chip away the gains made since $20k.

Therefore, traders and investors of Bitcoin are advised to proceed with caution by lowering their leverage on open positions and using stop losses as the week progresses.