The beginning of 2020 has seen a renewed interest in Bitcoin and cryptocurrencies. Public sentiment follows price, higher prices mean more attention, media outlets suddenly start putting out projections for new all-time highs.

Each new wave of positive press brings in crypto newbies who only know that people seem to be getting rich and they aren’t. If you couldn’t be bothered to click it, that linked article is titled “Everyone Is Getting Hilariously Rich and You’re Not.”

Instead of following headlines like these and getting rekt, better to learn from the mistakes of others. In this piece, I’ll be going over what I, and Twitter, believe are the biggest mistakes made in crypto to date.

In mid-February, I put out a general question to Twitter and tagged a few friends to see what kind of reactions I got.

FOMO at the Top

The Fear of Missing Out or “Fomo” is the emotion felt when there is a fear of “not being included in something.” Seeing friends go out to have a good time can cause this. Or seeing everyone post their paper profits on social media can cause a similar emotional response.

While buying at the top of a price chart is not necessarily a bad thing, blindly buying the top is a more direct path to losing all your money. Below is a graph of the Total Crypto Market and the date of that fomo-inducing article from earlier.

Scary right? The sentiment at the time was that Bitcoin was going to the moon. The journey from $1,000 BTC to $20,000 BTC took less than a year, with most of the increase coming in just a few weeks. The lesson here is don’t blindly buy the top.

Irresponsible Investing

It’s become a meme at this point, but do NOT invest more than you can afford to lose. This should be a simple concept: investing and losing your rent money/college tuition/vacation/emergency fund are all paths towards financial ruin. Ignore that greedy voice that tells you to put in more.

Better to have a specific fund that is used for high-risk speculative investing. Some analysts (and people who do this for a living) have suggested that 1% of a total portfolio should be allocated for this.

Yes, I know establishing clear goals and managing risk is not the most exciting aspect of investing. But creating an executable plan could potentially be the difference between modest gains and total loss.

Another aspect of irresponsible investing is blindly following charts of calls from popular social media analysts. @KoreanJewCrypto paraphrases very succinctly:

It’s always a siren call to follow the biggest social media accounts. The reasoning is “They have all these followers so they must be good.” The better path is to review each asset on their respective fundamental and technical merits. Or, in other words, Do Your Own Research (DYOR).

Sell the Bottom

The flip side of buying the top is selling the bottom. In hindsight, it seems simple enough to not sell the exact bottom of a price chart, but human emotions can be tricky and confusing. The relationship between emotions and economic markets is even less understood.

Seeing an investment lose 80% of its value in a few months is enough to make even the most hardened investor write off their losses, let alone Joe 6-Pack who heard about Bitcoin around the water cooler.

In contrast to its euphoric “Getting Rich” article, the New York Times printed a companion article near the absolute bottom of the last chart, bemoaning the retrace.

Bragging About Your Gains

Alright, so maybe you did well in the crypto markets. Your bags pumped 1,000X and feel like the smartest man alive. Surely the smart thing is to tell your friends how well you did. Hell, might as well brag to your inlaws who said crypto was a scam, and rub it in the face of your Tesla-shorting nemesis on social media.

DO NOT DO THIS. Broadcasting your wins to the world only makes you obnoxious and increases your visibility. The world is full of individuals who have been scammed, kidnapped, and profiled because they won the lottery or had a similar financial windfall.

In fact, lottery winners declare bankruptcy more often than not. Why? Because if they were experts in personal finance they probably wouldn’t need to play the lottery in the first place. Better to keep your wins between you and your financial advisor. And for the love of God, don’t put a Bitcoin bumper sticker on your vehicle.

Now, I’m not saying you can’t celebrate. The financial world is full of analysts recapping their correct calls and plays. A number of people I follow on social media will post their wins in a respectful manner. This behavior is fine, as there’s much to learn from someone’s trading history, especially if they also post their losing trades. Be cognizant that as the crypto market grows Twitter and Youtube will be overrun with people bragging about their “price calls.”

Ignoring Other Investments

“All in on crypto, bro! Screw stonks!”

Stop it. Just because crypto is doing well does not mean that there are no other bull markets. While cryptocurrencies may be getting more attention lately, the traditional stock market has been posting new highs consistently over the last 10 years.

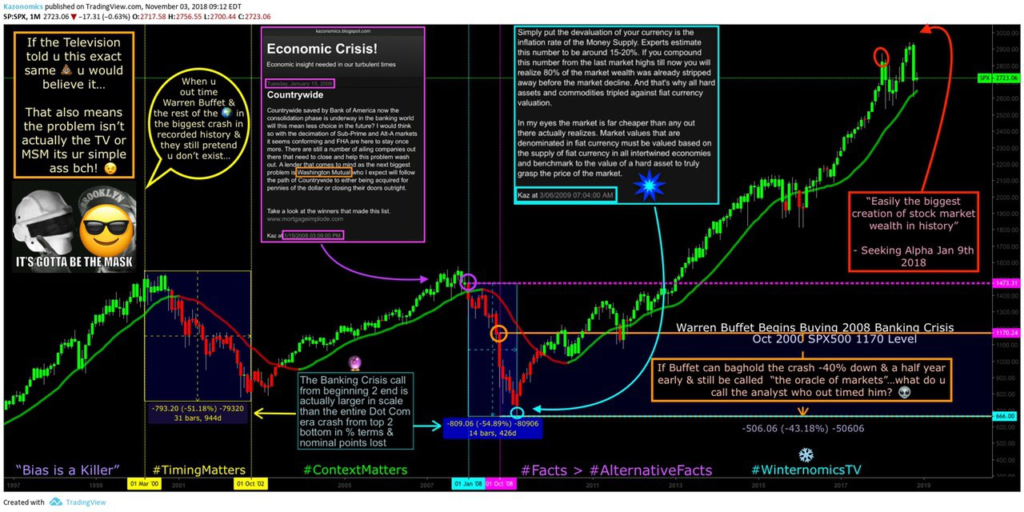

Pundits on nationally broadcast programs regularly warn that we are heading for a new recession, scaring away the masses from the market. Meanwhile, online analyst Kazonomics has a different perspective.

And here is a slightly cleaner version.

Look at this graph of the S&P 500. Did you miss out on these gains? I know 10% annual returns aren’t the “sick gainz” that crypto has experienced in the past, but it IS more reliable and less volatile overall. Conscientious investors have been in this market and seen great returns.

Forgetting What You Own

This may seem like a strange topic. In other investments like stocks, all assets are available when you log into your portfolio. Even Coinbase shows all the coins/tokens you have once you log in.

However, for users who choose to hold their private keys, this is a real concern. Misplacing or losing private keys means the crypto in these wallets are lost and gone forever. Sure, you can see how they are appreciating/depreciating over time, but there is no way to access those funds.

The number of people I talk to who do NOT have wallet backups is astounding. One house fire or hard drive crash could eliminate 100% of their crypto portfolio. The irony is that while crypto is decentralized, individuals are often the single point of failure.

As cryptocurrency projects are updating their code base and wallets, there are examples where a wallet upgrade or token swap can invalidate or freeze those affected coins. Coin communities will often remind users of these upgrades but if you haven’t checked on your crypto in 6 months you may find you missed your chance to swap them out for the latest version of the wallet.

ICX was a big coin that underwent a token swap in 2018. A number of very vocal holders saw their investment go to zero as they tried to access their tokens after the swap.

Does this mean you need to spend time in the Telegram or Discord chats for every crypto asset you own? Yes, it sure does. Check-in once a week or find an online buddy who keeps you abreast of any news or software changes.

TLDR

Still reading this far? Congratulations, you officially have an attention span longer than most Americans. If there’s one lesson to take away from these examples it’s to learn from the mistakes of others. Exercise caution and put in the work prior to putting your hard-earned capital at risk.

Thanks to everyone who responded to this thread.

Feature by FomoHunt.

The post 6 Biggest Mistakes in Crypto appeared first on BlockNewsAfrica.

Post source: 6 Biggest Mistakes in Crypto

More Bitcoin News and Cryptocurrency News on TheBitcoinNews.com