The cryptocurrency economy has been higher in value than ever before as bitcoin has touched an all-time price high at $24,298 per unit. Regardless of the all-time price highs, the world’s bitcoin miners are not spending more bitcoin than usual according to onchain statistics. Bitcoin miner outflow has been higher during the bull run but also lower than the 2019 top.

Speculators assume that when the price of bitcoin (BTC) rises, bitcoin mining operations will sell more coins. However, while BTC has touched a new all-time high (ATH), miners are not selling more bitcoin than usual according to data from onchain charting sites like Cryptoquant and Glassnode. On December 22, the onchain researchers from Glassnode explained how miners are not spending more than usual during the ATH.

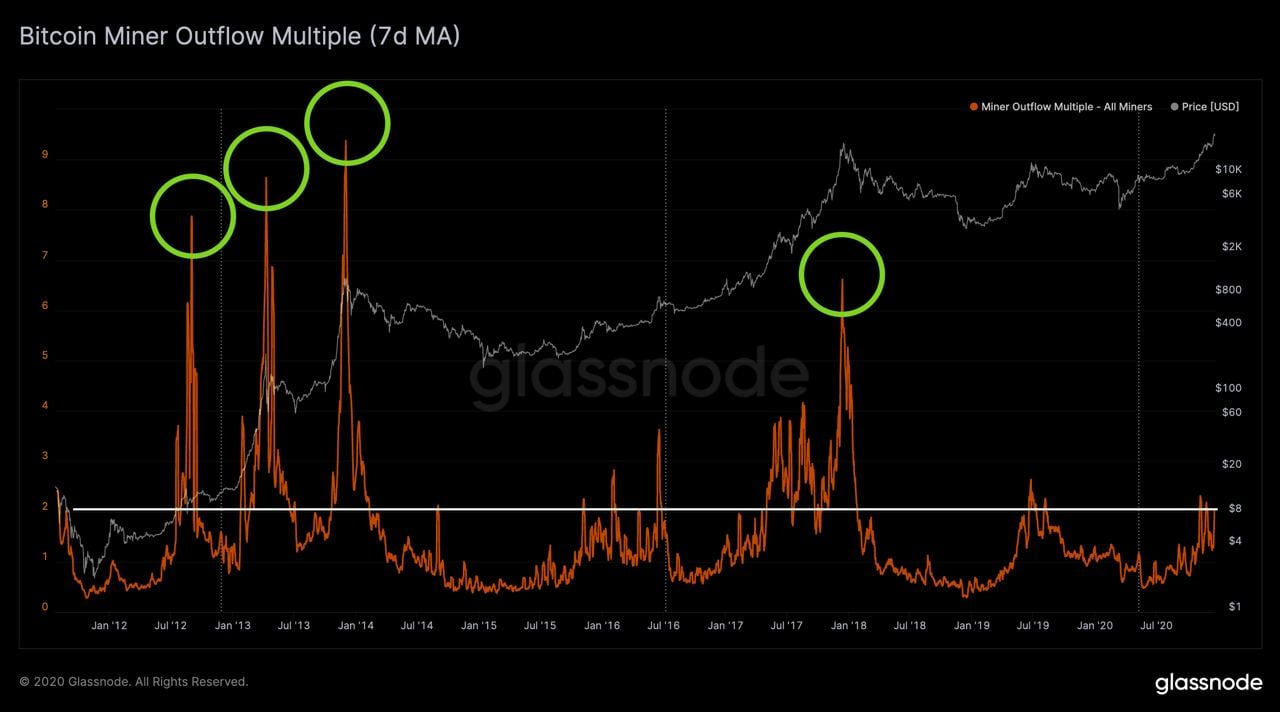

“Despite the recent rally, Bitcoin miners are not spending more BTC than usual,” Glassnode said on Tuesday. “The Miner Outflow Multiple, which shows when BTC miner outflow is high with respect to its historical average, is far from previous tops and even below the 2019 local top.”

Since the halving and the bull run that followed a few months later, bitcoin miners have been profiting a great deal. Before the halving, it was estimated that miners need BTC prices to be around $12,500 to break even at revenues obtained before the halving.

The overall hashrate is very high at 139 exahash per second (EH/s) as 14 mining operations are point hashrate at the BTC chain. With prices above the $23k handle, bitcoin miners and even older generation mining rigs like the S9 are seeing significant profits.

At the time of publication, 18,579,969 BTC are in circulation today and so far that’s 88.48% of the 21 million supply cap. BTC’s inflation per annum has dropped considerably to 1.78% after holding a rate of above 3.6% before May’s halving.

On average $20,961,900 worth (at today’s exchange rates) of BTC is issued by miners every day at 144 blocks per day. Yesterday 147 BTC blocks were found and 2,037 blocks were found during the last 2 weeks at 6 blocks per hour.

While the BTC coinbase rewards have a two-week average of $146,046 per block the average aggregate number of fees per block is 0.81 BTC or $18,837. Glassnode’s onchain stats show that entities are holding onto coins longer, according to the “realized hodl ratio” during the last seven days.

In addition to data from Glassnode, miner outflow stats from Cryptoquant indicates that bitcoin miner selling has not increased a great deal with BTC prices so high. Cryptoquant tracks data from major BTC mining pools like Antpool, Poolin, Btc.com, F2pool, Viabtc, Slush, Dpool, Bytepool, and others alongside the smaller unknown mining pools as well.

What do you think about miners holding onto their newly minted bitcoins? Let us know what you think about this subject in the comments section below.

The post Despite Bitcoin’s Price Highs, Onchain Data Shows BTC Miners Are Not Spending More Than Usual appeared first on Bitcoin News.