The crypto market has exploded since January of this year (2021). However, as the year is ending, the run hasn’t been as consistent as it was expected. Coins have seen massive highs and lows.Ethereum is up 500%, Binance Coin was previously up by 1,700%, and it then slumped to 1500%. Avalanche is up 2,500%, and Solana is up a whopping 18,000%!

But Bitcoin is up only 113%. In fact, during the greatest bull run in crypto history, Bitcoin has greatly under-performed the market average of 250%.

Let’s see why that might be.

Altcoins are in. Bitcoin is out.

The most effective tool for visualizing overall altcoin performance is the Bitcoin Dominance chart. It shows changes in Bitcoin’s total share of the cryptocurrency market over time.

By looking at the Bitcoin Dominance chart for 2021, we can see that Bitcoin’s share of the cryptocurrency market has trended downwards from a high of 74% to a low of 40%. This means that the altcoin market has been rising against Bitcoin, and may continue to do so.

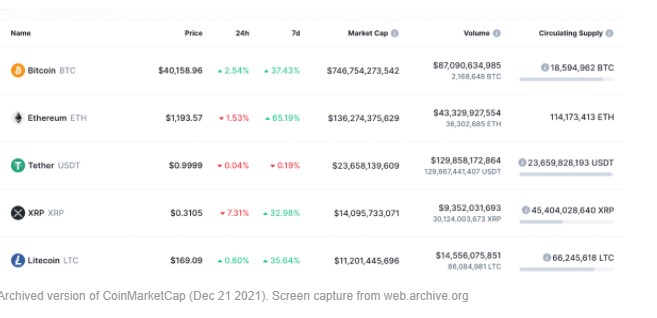

Using the WayBackMachine, a tool for looking at archived versions of websites, we can see what CoinMarketCap looked like when Bitcoin dominance was at its peak in January:

In order, the Top 10 coins were:

- Bitcoin

- Ethereum

- Tether

- XRP

- Litecoin

- Cardano

- Polkadot

- BitcoinCash

- Stellar

- Binance Coin

The best-performing altcoins have two things in common: smart contracts, and low transaction fees.

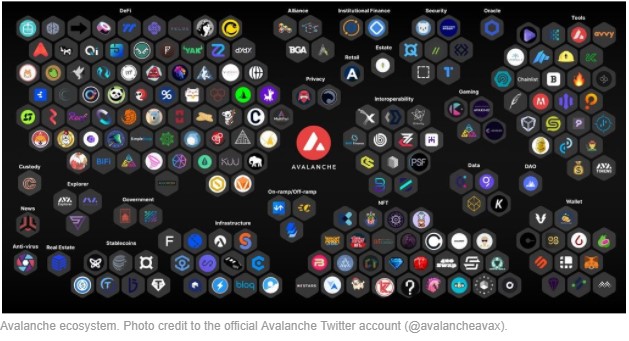

Binance Coin, Solana, and Avalanche climbed the most ranks. Like Ethereum, they run smart contracts. However, their transaction fees are substantially lower.

Because of their utility and low fees, thousands of crypto projects and tokens have been built on top of these coins, flooding the altcoin market with cash.

Altcoins have a distinct advantage because Bitcoin has limited utility.

What’s Next for Altcoins?

Because it’s so fast-moving, cryptocurrency is all about narrative. What’s hot right now? What’s next?

Most of the new projects in 2021 had to do with DeFi. Some topics that are gaining traction now are: metaverse, NFTs, and WEB3.

For example, Sandbox, a gaming metaverse project, recently pumped. But if you weren’t lucky, you probably missed it.

How to Find Altcoin Gems

There are over 7,000 cryptocurrencies on CoinMarketCap, and dozens of new ones are listed daily. On top of that, it’s hard to figure out which have actual utility, rugpulls are everywhere, and scammers run amok!

You may have noticed scammers pretending to be popular crypto influencers, social media pages, or Telegram channels.

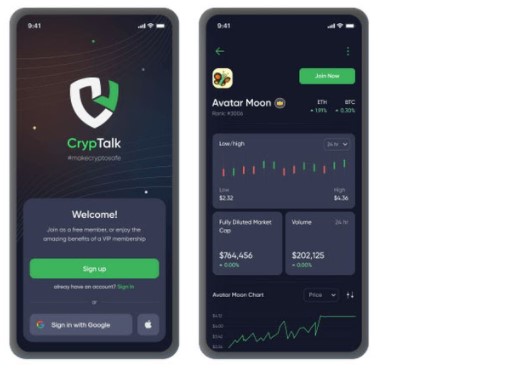

Thankfully, there is a solution that will solve these problems, called CrypTalk!

CrypTalk is an encrypted messenger built for the crypto community, and is designed to help you find projects in a safe way. It will do it so by:

- Requiring project CEOs to verify their identities through KYC process

- Auditing projects so you know they aren’t malicious

- Keeping important information all in one place like price and market cap

- Bringing important crypto news directly to you

- Allowing users to vote on channels

Their beta is launching on Q1 2022, so if you want in, be sure to sign up for their newsletter on their website.

Conclusion

We examined how the utility that altcoins provide may keep them pumping into 2022.

Do you agree? And if yes, which altcoin do you think will pump the most? Let us know, and tag your reply with $CRYP #CRYP #CrypTalkToken.

Thank you for reading!

Post source: 2022: Will Altcoins keep Performing? Or is There a Downturn on the Cards?